Description

“North East Way EA” refers to an Expert Advisor (EA) used in forex trading. An EA is a type of automated trading software that operates within trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). Here’s a comprehensive guide to understanding and evaluating an EA like “North East Way EA”:

### Understanding North East Way EA

1. **What is it?**

– **Expert Advisor (EA):** The North East Way EA is a software program designed to automate trading decisions based on predefined criteria and algorithms. EAs execute trades automatically according to the parameters set by their developers.

2. **Trading Strategy:**

– **Strategy Overview:** Investigate the trading strategy behind North East Way EA. This could involve trend-following, scalping, range trading, or other methods. Understanding the strategy helps in assessing its potential effectiveness.

– **Indicators and Algorithms:** Determine which technical indicators and algorithms the EA uses. This information is crucial to understanding how the EA makes trading decisions.

### Evaluating the EA

1. **Performance Metrics:**

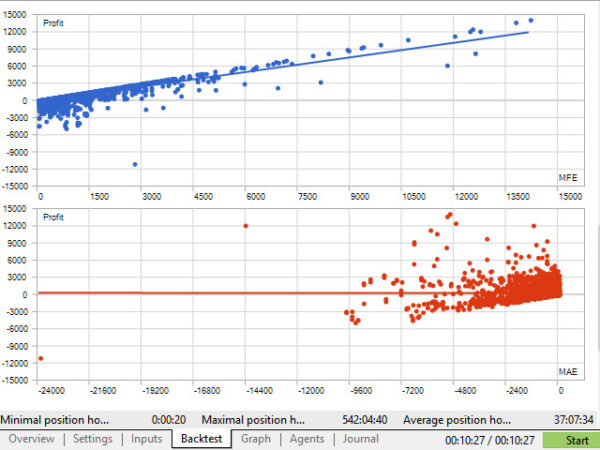

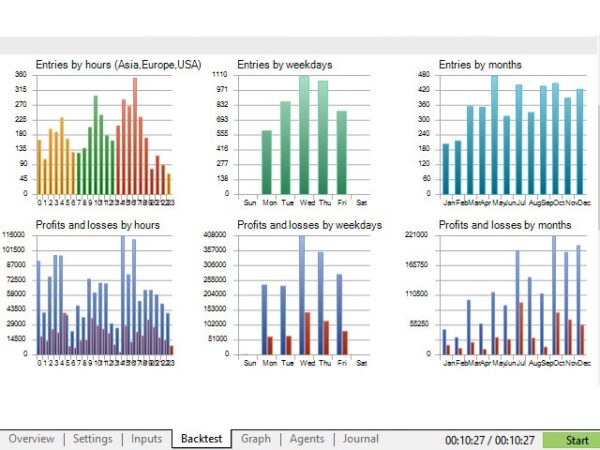

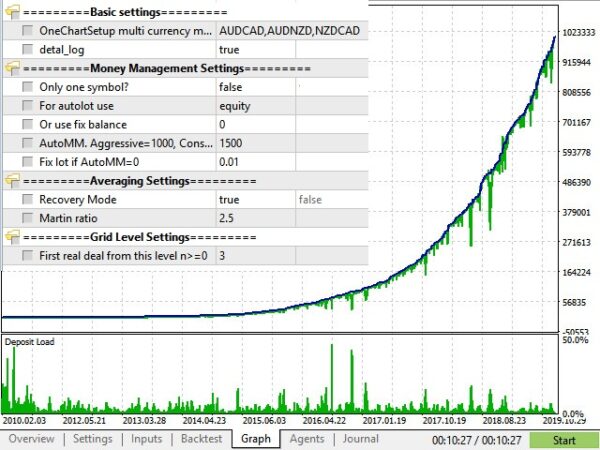

– **Backtesting Results:** Look for backtesting data that shows how the EA has performed historically. This includes metrics like profitability, drawdowns, and win/loss ratios.

– **Live Trading Results:** If available, review live trading results to see how the EA performs in real market conditions. Live results are often more indicative of future performance.

2. **User Reviews and Feedback:**

– **Find Reviews:** Search for user reviews and testimonials. This can provide insights into the EA’s effectiveness and reliability from the perspective of other traders.

– **Trading Communities:** Explore trading forums or communities to find discussions and feedback about North East Way EA.

3. **Credibility of the Developers:**

– **Developer Information:** Check the credentials and background of the developers or creators of North East Way EA. Reputable developers are usually transparent about their experience and qualifications.

– **Support and Updates:** Ensure that the EA comes with good customer support and regular updates to address any issues or adapt to changing market conditions.

4. **Testing the EA:**

– **Demo Account Testing:** Before using North East Way EA with real money, test it on a demo account. This allows you to evaluate its performance and functionality without financial risk.

– **Risk Management:** Assess how the EA handles risk management and ensure it aligns with your own risk tolerance and trading strategy.

5. **Cost and Value:**

– **Pricing Structure:** Determine the cost of the EA and whether it fits within your budget. Some EAs may have a one-time purchase fee, subscription fees, or other pricing models.

– **Value for Money:** Evaluate whether the features and performance justify the cost. Compare it with other EAs or trading tools available in the market.

6. **Understanding Risks:**

– **Risk Assessment:** All trading systems, including EAs, involve risk. No system can guarantee profits, so it’s important to understand the potential risks and have a clear risk management plan.

### Additional Resources

Reviews

There are no reviews yet.